will advance child tax credit payments continue in 2022

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

. The temporary expansions to the Child Tax Credit CTC dramatically reduced the share of children experiencing poverty in 2021 especially for Black and Latinx kids. 23 hours agoThe Fed plans to raise interest rates again in June to cool rampant inflation fueled in part by gas prices that continue to climb into uncharted territory. In the meantime the expanded child tax credit and advance monthly payments system have expired.

If youre received advanced child tax credit payments at any time during 2021. This final installment which. The third round of Economic Impact Payments including the plus-up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return.

The letters will continue being sent out into January. As of now the size of the credit will be cut in 2022 back to. Irs refund child tax credit schedule 2022.

Letter 6419 includes the total amount of advance child tax credit payments. The American Rescue Plan signed into law earlier this year enhanced the 2021 child tax credit increasing its maximum value. The plan was always for another payment to be made in April.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. 15 rounding out a six-month series of checks that supported an estimated 61 million American kids. About 40 of recipients said they mostly relied on the money to pay off debt.

COVID Tax Tip 2022-03 January 5 2022 The IRS started issuing information letters to advance child tax credit recipients in December. The advanced payments of the credit will continue in 2022 as. The payments wont continue in 2022 for the new year.

It isnt considered taxable income and it wont affect any government benefits. If a family meets the income requirements and has received each payment between July and December of this year they may receive up to 1800 for each child. 7 2022 200 pm.

The IRS has a system in place for making monthly payments but when legislation isnt passed early enough. The expansions also lowered food insecurity rates helped families afford necessities and reduced financial stress for parentsBut since the. This blog was updated on May 24 2022.

Now families are asking. The advance payments are 50 of the credit youre expected to qualify for when you file your 2021 tax return. However parents might receive one more big payment in April 2022 as part of last years plan.

HOW MUCH MORE MONEY WILL I GET IN 2022. With six advance monthly child tax credit checks sent out last year only one payment is left. Distributing families eligible credit through monthly checks for.

It was issued starting in March 2021 and continued through December 2021. The Child Tax Credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021. Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the end of January.

Advance child tax credit payments in 2021 reduced child poverty by 40. Congress fails to renew the advance Child Tax Credit. Those have all now been paid out but these six advance checks only accounted for half of the 2021 tax year Child Tax Credit payments.

The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax. The IRS sent the last child tax credit payment for December 15 2021. Individuals should review the information below to determine their eligibility to claim a Recovery Rebate.

It could also change whether the monthly installment payments continue in 2022. The Child Tax Credit for 2021 introduced a new feature. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

More than 36million families across the country received the final batch of advance monthly payments totaling about 16billion. Families who received advance payments will need to file a 2021 tax return and compare the advance child tax credit payments they received in 2021 with the amount of the CTC they can properly claim on their 2021 tax return. Most payments were made by direct deposit.

The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec. You see monthly payments started arriving. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

Those returns would have information like income filing status and how many children are living with the parents. Regardless of what happens with the Child Tax Credit anyone who received the benefit in 2021 should make it known on their tax return. In most cases receiving the Child.

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

What Families Need To Know About The Ctc In 2022 Clasp

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Enhanced Child Tax Credit To Continue For 1 More Year Per Democrats Plan

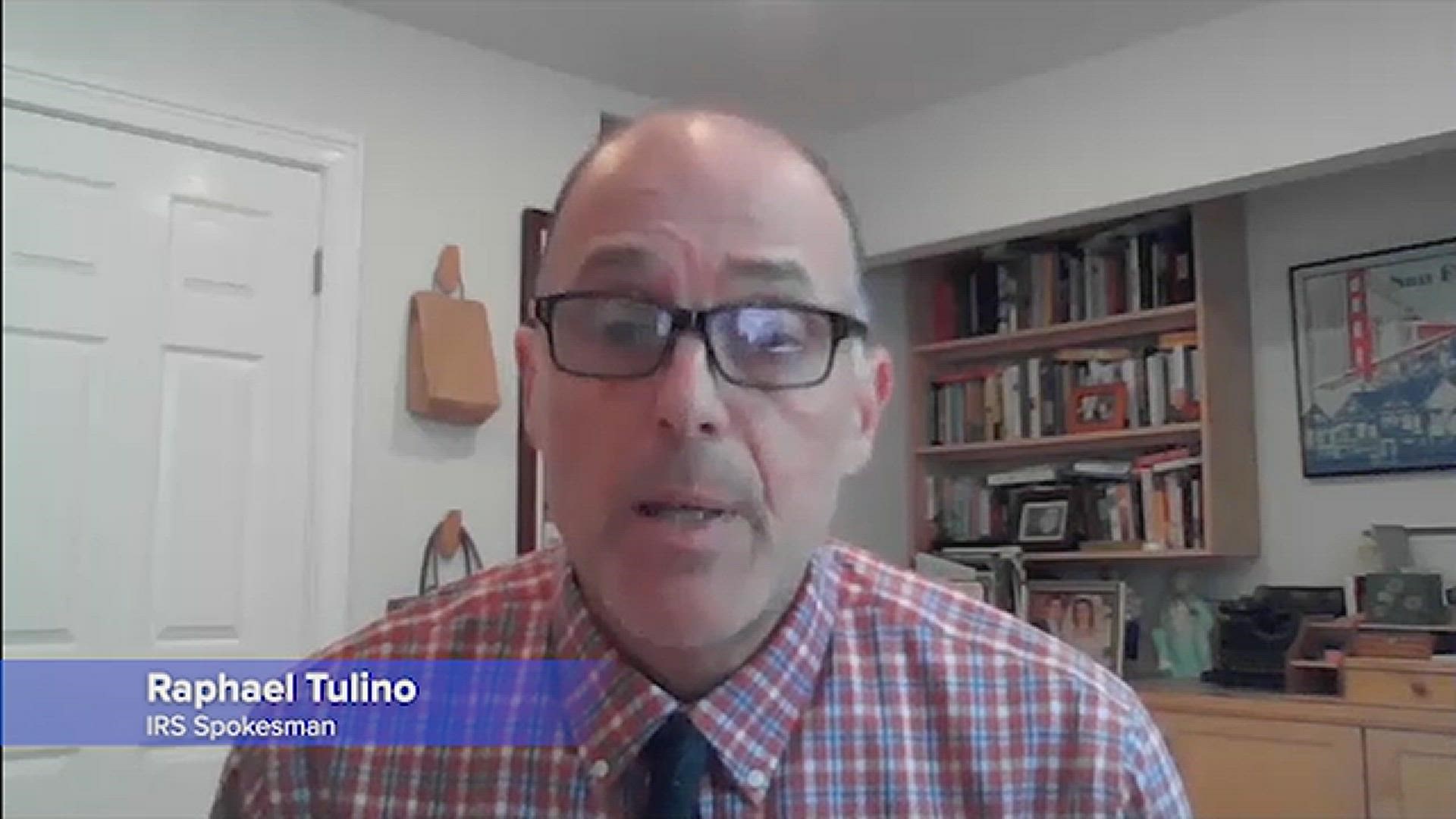

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Will Child Tax Credit Payments Be Extended In 2022 Money

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Irs Child Tax Credit Payments Start July 15

Stimulus Update Here S Why Some Families Will Receive 3 600 Child Tax Credit Payment In 2022 Silive Com

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Explaining The New 2022 Child Tax Credit And How To Claim Familyeducation

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

No More Monthly Child Tax Credits Now What

Advance Child Tax Credit Payments Are Done But You Might Still Be Owed More Here S How To Find Out

Opinion Prices Just Keep Rising It S Time To Revive The Enhanced Child Tax Credit Cnn Business