ge stock split good or bad

For each eight GE shares an investor owns they would come out the other. In 2011 the company underwent a 1-for-10 reverse stock split and also reinstated its dividend that brought its.

Ge Stock What A Disaster Nyse Ge Seeking Alpha

Since its September 2014 inception the ETF has returned 97 percent more than the 39 percent of the.

. New York CNN Business General Electric the industrial conglomerate founded by Thomas Edison in 1892 is breaking up. This was a 2 for 1 split meaning for each share of GE owned pre-split the shareholder now owned 2 shares. I ran into my friend a few weeks ago and asked about the stock.

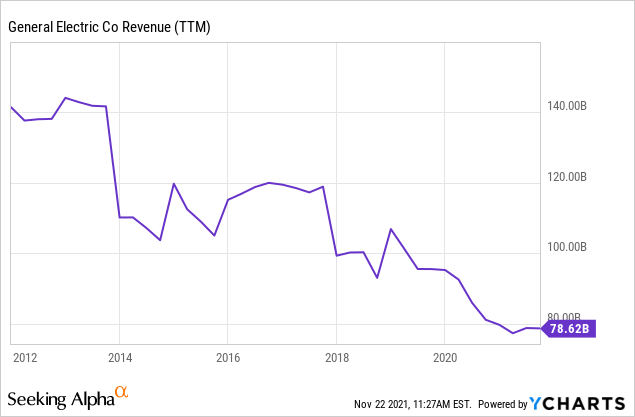

The arrival of the COVID-19 pandemic cut short the rebound in the share price. GEs reverse stock split means share price will no longer be a factor for investors deciding between it and other industrials. He was wondering if that reverse stock split was a good or bad thing.

General Electric GE has 8 splits in our General Electric stock split history database. This technique has been described as accounting sleight of. Earlier this season GE engineered a reverse stock split reducing outstanding shares in order to elevate their value.

A reverse stock split can be used to condense and combine stock shares. Combined with the previous recommendation to cover 50 of the position this results in a net investment return over 52. The company says that this would line up its number of shares to other companies with similar.

Citigroup is often used as an example. Based On Fundamental Analysis. On May 15 2020 the stock fell to 4392 a 28-year low.

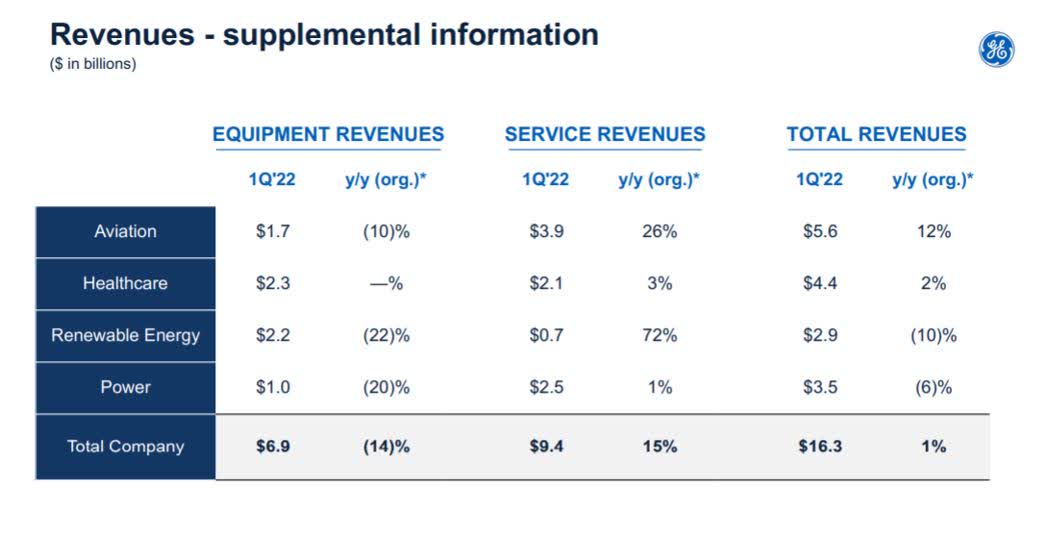

The remaining GE will be an aviation-focused company. The process will result in. GE announced plans Tuesday to split into three separate companies.

For example a 1000 share position pre-split became a 2000 share position following the split. The first split for GE took place on June 08 1971. The reverse stock split authorized share reduction.

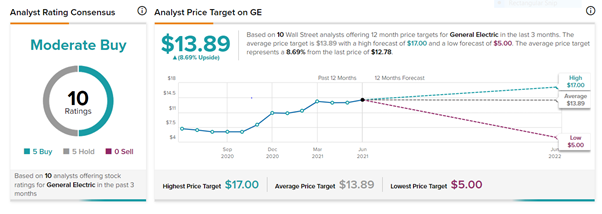

In general stock splits and reverse stock splits are neither good nor bad for investors. GE shares have fallen 58 percent over the last five years. While a reverse stock split can improve a stocks price in the near term it could be a sign that a company is struggling financially.

They are set to open at 10375 as of early Monday morning. For example in a 14 reverse split the company would provide one new share for every four old shares. Shares of GE closed at 1295 on the New York Stock Exchange on Friday.

They only change the share count but do not impact the percentage of the company as a whole that an. As a General Electric shareholder I am thrilled that GE will split itself into three public companies according to the Wall Street Journal. The stock has delivered a negative.

A stock split does not in itself affect a. So if you owned 100 shares of a 10 stock and the company announced a 14 reverse split you would own 25 shares trading at 40 per share. S plan to pursue a reverse stock split would make it one of the few blue-chip companies in recent years to use a strategy that has been more common among firms.

The Panic-Proof Portfolio Stockchase Research 12590. Corbis via Getty Images. According to the companys press release the reverse stock split of 1 for 10 would bring the stock price up to 5 per share and that would prevent the stock from being delisted from the Nasdaq.

In a reverse stock split a company issues one new share in exchange for multiple shares of the old stock. GE said Wednesday that its board has recommended a 1-for-8 reverse split. GE is recommending that shareholders of its stock approve a proposed 1-for-8 reverse stock split.

A reverse stock split can be used to condense and combine stock shares. The Stock Split Index fund launched last September invests in 30 recently split stocks. After the split GE will have just 11 billion shares outstanding with a stock price that should come in just over 100 per share based.

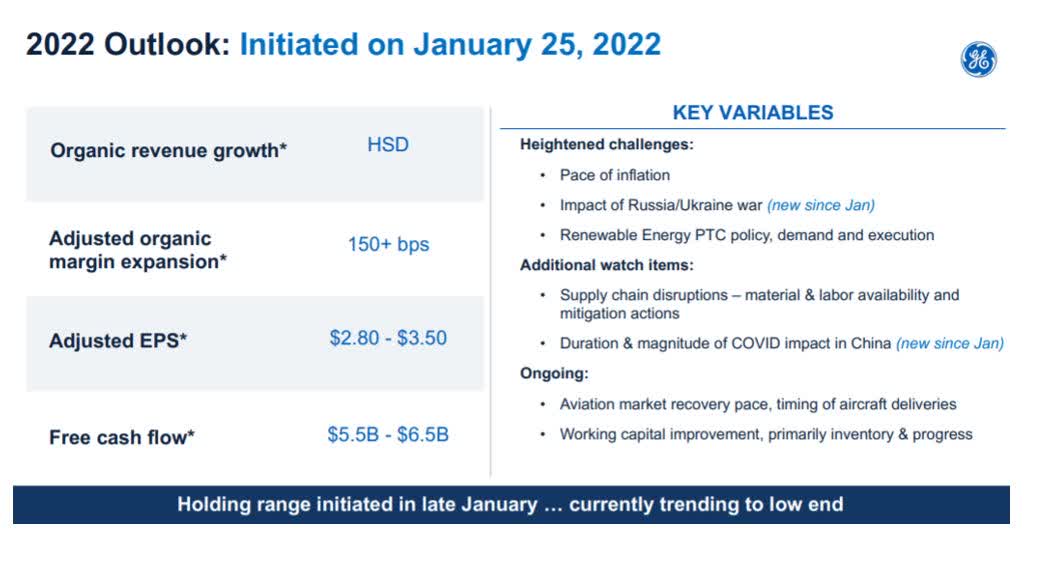

The GE Power GE Renewable Energy and GE Digital units will be put together and spun off in 2024. BOSTON July 30 2021 GE NYSEGE announced today that it has completed the previously announced reverse stock split of GE common stock at a ratio of 1-for-8 with a proportionate reduction in the authorized shares of its common stock and reduction in the par value of common stock to 001 per share. General Electric GE-N 19072021 at 1200am.

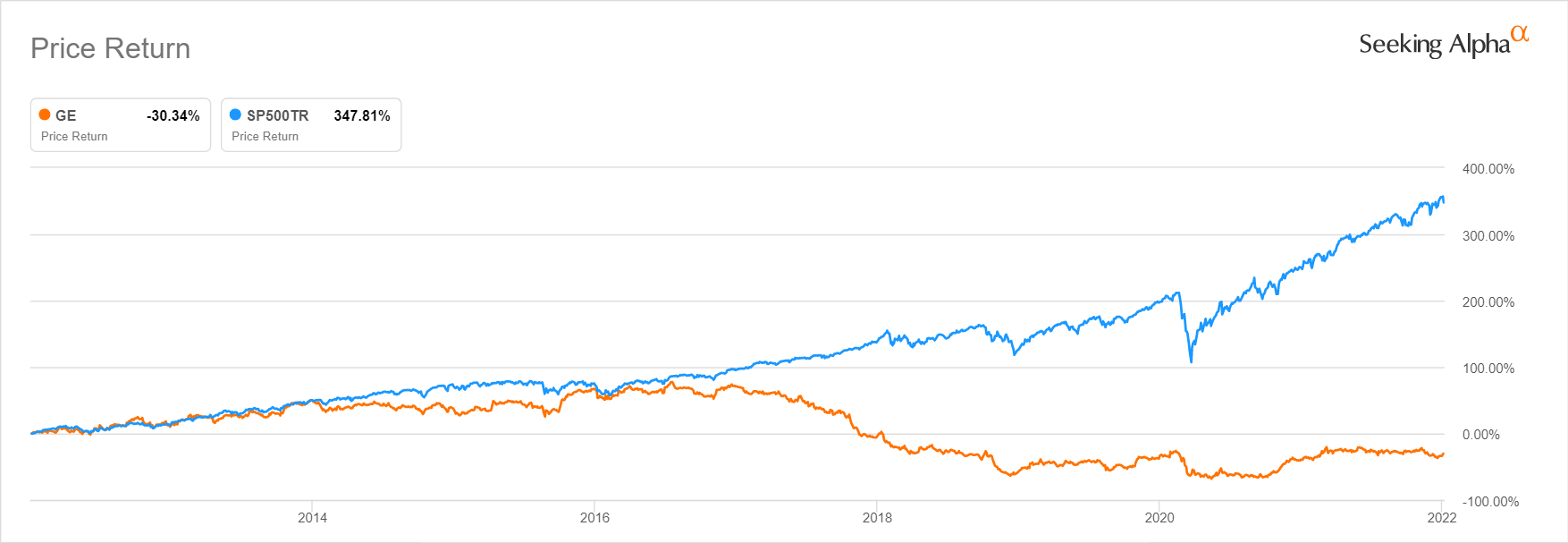

Ad Our Strong Buys Double the SP. This type of stock split is often done to increase share prices. While GE has outperformed the SP 500 in 2021 the long-term picture has not been good for the stock.

Ge Announces Date Of 1 For 8 Reverse Stock Split Declares Regular Quarterly Dividend

Is The General Electric Split Good Or Bad For Ge Stockholders 8 Things To Know Investorplace

Where Will General Electric Stock Be In 5 Years Nyse Ge Seeking Alpha

Where Will General Electric Stock Be In 10 Years Nyse Ge Seeking Alpha

Ge Stock Prices Are They Worth The Investment Gobankingrates

Ge Could Be A Great Dividend Stock Believe It Or Not The Motley Fool

Ge Stock Prices Are They Worth The Investment Gobankingrates

Here S When Ge Might Increase Its Dividend From A Penny

Is Ge Stock A Buy General Electric Earnings On Deck As Russia Ukraine War Adds To Uncertainties Investor S Business Daily

General Electric Sets Date For 1 For 8 Reverse Stock Split At Aug 2 Thestreet

Storied General Electric Plans To Split Into 3 Public Companies Npr

Ge Reverse Stock Split Proposed What You Need To Know Youtube

Here S When Ge Might Increase Its Dividend From A Penny

:max_bytes(150000):strip_icc()/ScreenShot2020-03-26at2.08.17PM-cf27dc70027b4510b72b2b3fc015bd4e.png)

The Rise And Fall Of General Electric Ge

Reverse Stock Split Excel Calculator And General Electric Ge Example

Where Will General Electric Stock Be In 10 Years Nyse Ge Seeking Alpha

General Electric Stock Above 100 As Reverse Split Takes Effect Seeking Alpha